kmi stock dividend safe

Kinder Morgans dividend is lower than the US Oil Gas Midstream industry average of 649 and it is higher than the US market average of 33. Drilling down into the dividend.

Kinder Morgan Right Dividend Industry And Stock Nyse Kmi Seeking Alpha

Ad Top dividend stock picks and tips from a trusted source since 1970.

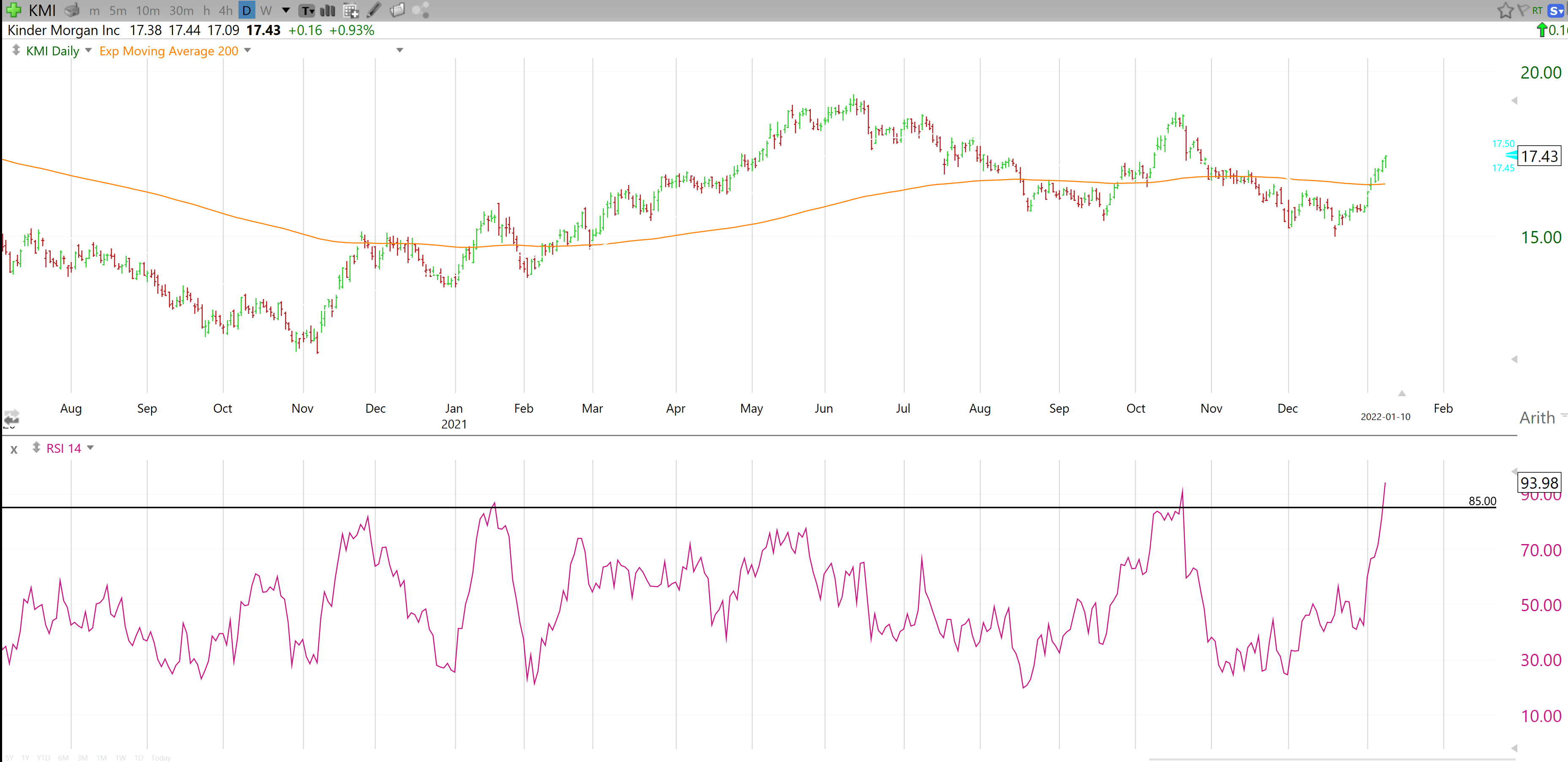

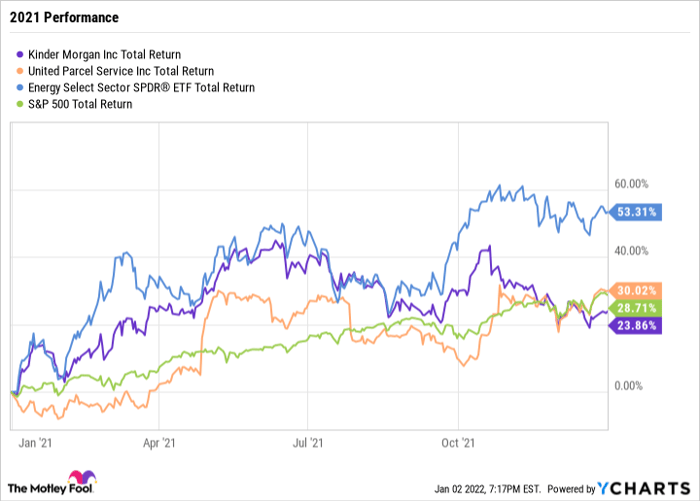

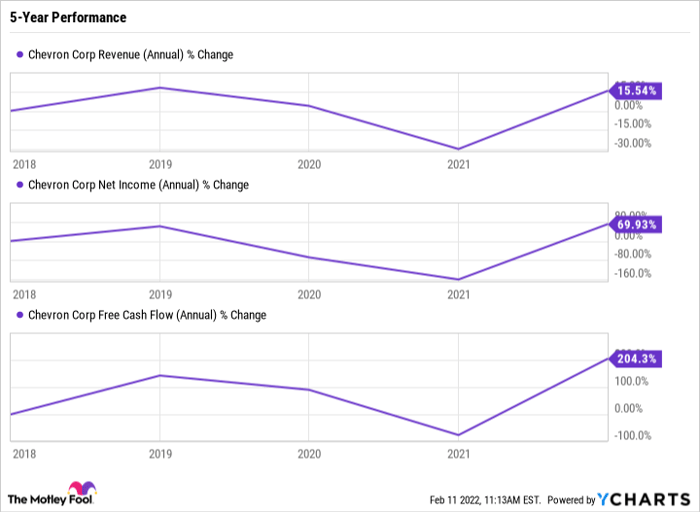

. KMI dividend safety metrics payout ratio calculation and chart. A recording of the conference call will also be available for replay one hour after the call until the end of the day on May 20 2022. Kinder Morgan produced a 239 total return in 2021 which sounds good until you consider that it underperformed both the SP 500 and the Energy Select Sector.

Kinder Morgan has 84000 miles of oil and gas pipelines and 157 terminals. 10093 based on next years estimates. For example Kinder Morgan Inc.

The stock pays a 025 per share quarterly dividend which comes out to a 5 yield. Over that same period Kinder Morgan Inc is on track to pay out 105 per unit in distributions. Grow your income with Cabots top dividend stock picks.

Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. A safe high-yield dividend stock. 13846 based on the trailing year of earnings.

This 5 Yield Is Safe for Now. Get your free report. Kinder Morgan KMI Dividend Yield.

Best dividend capture stocks in Apr. It divides the Forward Annualized Dividend by FY1 EPS. For 2020 management has estimated that the business would generate 459 in distributable cash flow.

Written by Marc Lichtenfeld Wednesday December 18 2019. Its one of the largest energy transportation and storage companies in North America which is important given the sanctions on Russia that are occurring at the moment. Lumen Technologies LUMN Source.

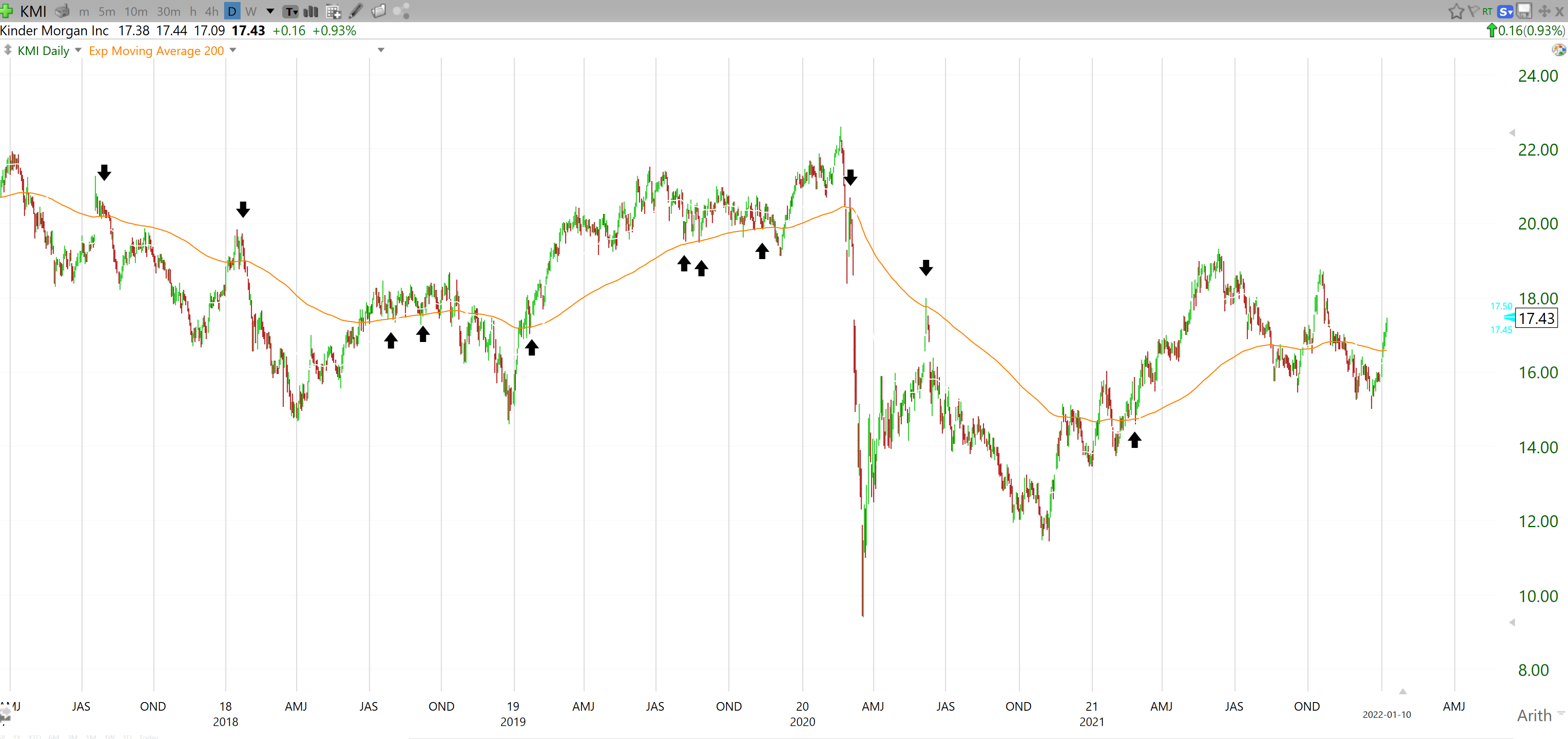

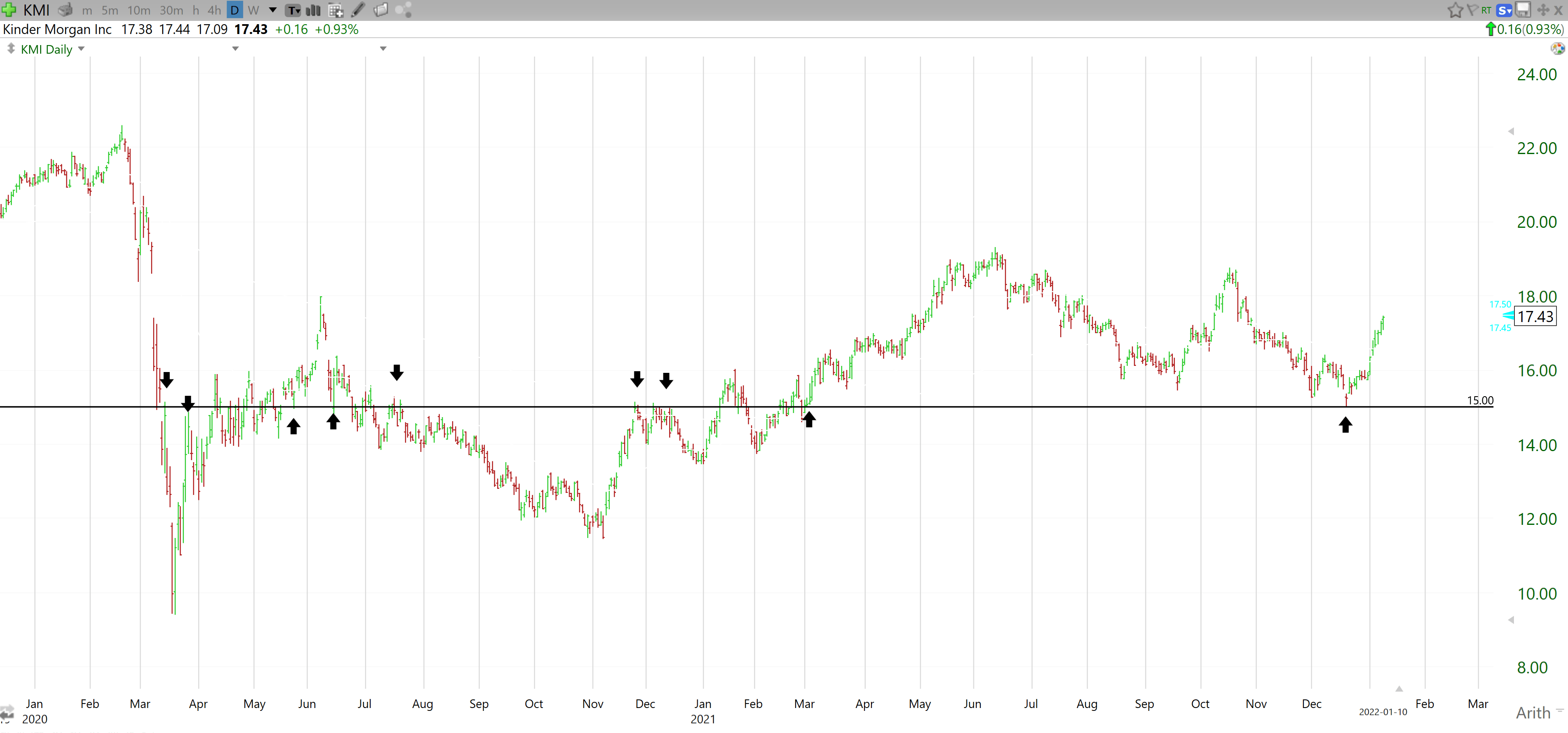

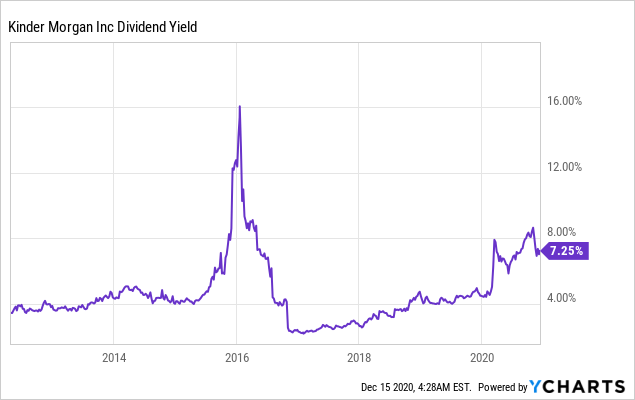

Find the latest dividend history for Kinder Morgan Inc. Near the peak of the coronavirus sell-off in March I stated that the dividend of Kinder. Kinder Morgan currently yields about 42 which is double that of the average stock in the SP 500The company plans on.

Its 76 dividend can be considered safe. 80 We finish off this list of oil stocks with one of North Americas largest energy infrastructure companies Kinder Morgan. Most dividend investors are aware of what happened to Kinder Morgan KMI and a bunch of other MLPs a few years ago.

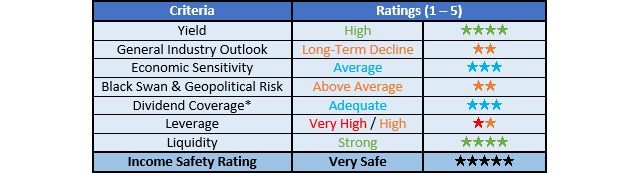

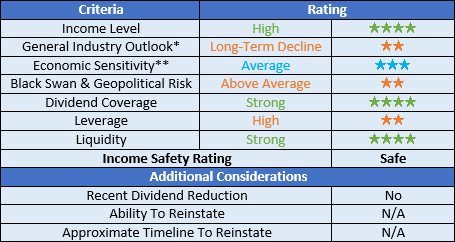

Market advice from the experts. Kinder Morgans dividend is one of the safest in the sector. Payout Ratio FWD Fwd Payout Ratio is used to examine if a companys earnings can support the current dividend payment amount.

Kinder Morgan Inc NYSEKMI The energy sector has been nothing short of impressive this year which makes a dividend growth stock like Kinder Morgan all the more attractive. HOUSTON-- BUSINESS WIRE-- Kinder Morgan Incs NYSE. This dividend is a 3 increase over the fourth quarter of 2020.

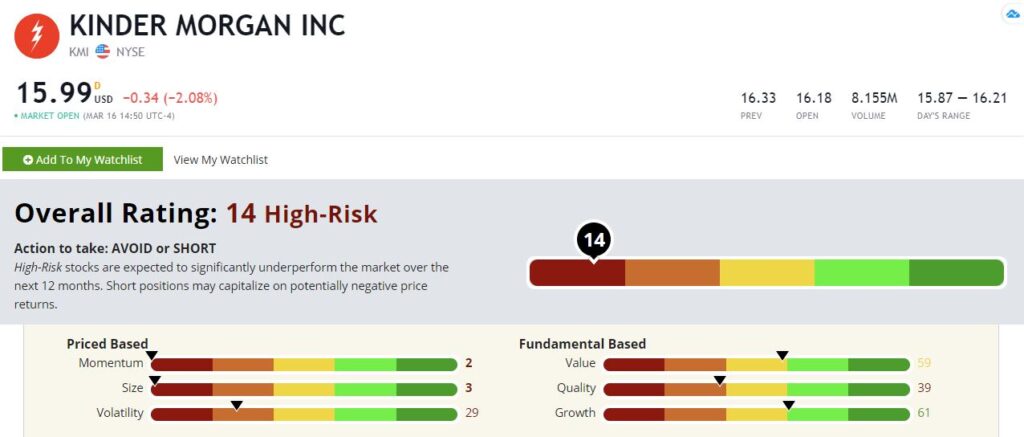

A stable dividend payer those looking for relatively safe high-yield have a great option when it comes to KMI stock. The Kinder Morgan Debacle. KMI is one of the largest energy infrastructure companies in North America.

KMI has drastically reduced its debt load in recent years. KMI is one of the more popular pipeline companies with investors. KMI board of directors today approved a cash dividend of 027 per share for the fourth quarter 108 annualized payable on February 15 2022 to stockholders of record as of the close of business on January 31 2022.

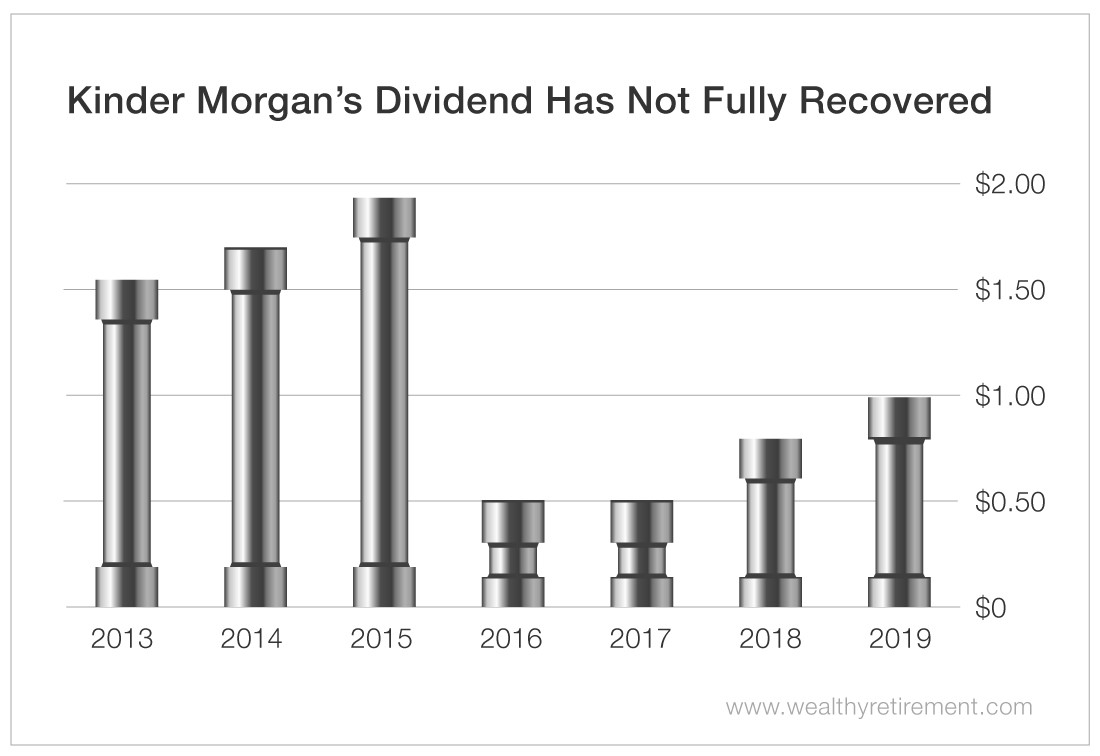

4779 based on cash flow. Kinder Morgan has gone from having a weak financial profile to one of the strongest in the pipeline industry and now the. Today Kinder Morgans lower dividend amount appears to be more sustainable thanks in part to the companys dividend coverage ratio DCFdividend cost of 41.

In fact just before managements shocking decision to cut the dividend in December 2015 Kinder Morgans Dividend Safety Score was an 8 indicating very high risk of a dividend cut. KMI pays a dividend of 107 per share. KMI is rated a C even though its payout had more than doubled in 2020 from 2017 in part because the pipeline operator cut its dividend by 75 late in 2015.

The dividend payout ratio for KMI is. Kinder Morgan Announces 02625 Per Share Dividend and Results for Second Quarter Of 2020 Kinder Morgan Inc July 22 2020. To access the replay please dial 1-203-369-0194 and enter passcode 63871.

Investing in safe high dividend stocks is a smart long-term strategy at least for a part of your portfolio especially for people that need reliable investment income or that like to. Kinder Morgans common stock offers a healthy 746 dividend yield. 10093 based on this years estimates.

About Kinder Morgan Inc. KMIs annual dividend yield is 629. The company has a track record of having stepped up dividends in the last four years exceeding expectations every time.

Cash Dividend On The Way From Kinder Morgan Kmi Nasdaq

Kinder Morgan Right Dividend Industry And Stock Nyse Kmi Seeking Alpha

Kinder Morgan S Nyse Kmi Dividend Outlook In 2018

Kinder Morgan Stock Dividends Are Going Higher Nyse Kmi Seeking Alpha

Kmi Kinder Morgan Inc Dividend History Dividend Channel

Kinder Morgan Right Dividend Industry And Stock Nyse Kmi Seeking Alpha

The Safest Energy Dividend Stock Right Now The Motley Fool

2 Wildly Undervalued Dividend Stocks To Buy In 2022 Nasdaq

Kinder Morgan Grab A 6 Dividend Before The Energy Bull Market

The 3 Safest Energy Dividends Right Now The Motley Fool

Is Kinder Morgan Stock A Buy The Motley Fool

Cash Dividend On The Way From Kinder Morgan Kmi Nasdaq

Kinder Morgan Stock Dividend Growth To Accelerate In 2022 Nyse Kmi Seeking Alpha

7 5 Inflation 2 Safe Dividend Stocks To Buy Now Nasdaq

Lock In The 7 5 Dividend Yield Of Kinder Morgan Before It Falls Further Nyse Kmi Seeking Alpha

Kinder Morgan Delivering More Reliable Dividends Intelligent Income By Simply Safe Dividends

Can This High Yield Energy Stock Support Its Dividend The Motley Fool